It Pays to Know Your Options

With premiums on BCBSVT and MVP Exchange plans proposed to increase up to 14.5% in 2026, your health care choices can make a big difference. For Vermont businesses insuring 5 employees or more, Blue Edge Business is an important alternative to consider as businesses are eligible to earn money back on annual premiums.

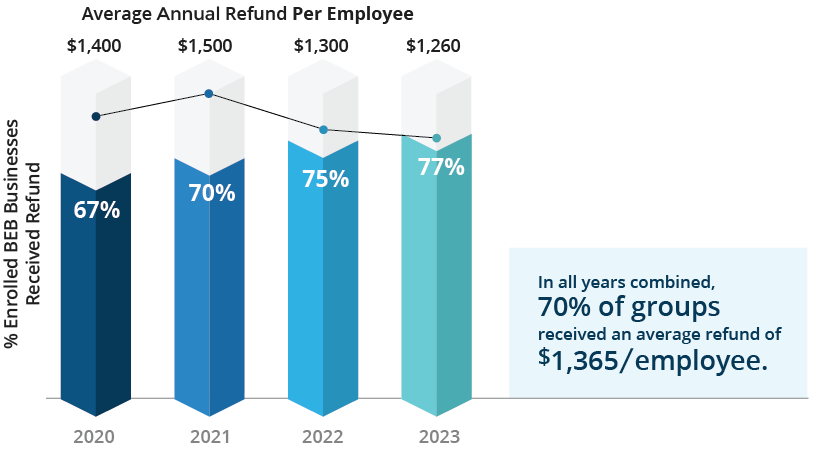

Over the past four years, 70% of businesses enrolled in Blue Edge Business have received an average refund of $1,365 per employee — each year.

Call us at (802) 865-4560 or fill out the form below to find out if these plans are the right choice for your business.

Now more than ever, health plan choices can make a big difference. As costs continue to rise, employers must understand all of the options available in order to identify the best solution for their business.

Through a partnership with Blue Cross and Blue Shield of Vermont, Blue Edge Business health plans combine the flexibility of self-funding with the peace of mind of predictable and capped monthly costs.

These plans are best suited for employers who:

- Have 5+ enrolled employees

- Are looking for an alternative to traditional health insurance programs

- Have or want to create a culture of health and wellness in the workplace

- Are committed to a multi-year partnership to achieve longer term, health outcomes for their employees

Blue Edge Business Overview:

- Four plan designs, available to groups with as few as 5 enrolled employees

- Maximum exposure quantified to make budgeting for health care expenses more predictable

- Businesses are eligible to earn money back on BEB premiums, and to share in positive claim results of the BEB group

- All four plans are HRA and/or HSA compatible

- New benefit: Acupuncture will be an added benefit for all 2025 plans

Blue Edge Business FAQs

Download Blue Edge Business FAQ sheet (PDF)

Qualifications

What criteria does a business need to meet to be able to apply for Blue Edge Business coverage?

The group must be a Vermont-based company with at least 5 enrolled employees. In addition, the company must be or become a member of BRS (Business Resource Services).

What company size is ideal for Blue Edge Business coverage?

The companies that are the best fit for Blue Edge Business typically have between 15 and 100 full-time employees.

The Application Process

Do I need a broker to apply for Blue Edge Business?

Yes, a broker is required. Because Blue Edge Business is part of a captive, it’s important to work with someone that can explain its requirements as well as the two potential opportunities for a refund of premiums.

What does the application process entail?

To obtain a quote, we need:

- Authorization from the group (an email request is sufficient)

- An employee census, including dependents

- Name of prior carrier / plan design

- Claims data, if available. Note: if coming from an MVP Exchange plan, there are no claims. A Cigna group may have claims available. If already a Blue Cross VT group, they have the claims data.

What is the timeline of a Blue Edge Business application?

A company can apply for a quote as early as July 1st. Quotes will be issued starting in September, in the order the requests were received. The last quotes are issued around Thanksgiving. Once the quote is issued, the group has 45 days to accept or until mid-December, whichever is earlier.

Premium Refunds

How many groups participating in Blue Edge Business have received refunds and what’s the average refund?

In 2023, 77% of businesses enrolled in Blue Edge Business received an average refund of $1,260 per employee. Over the past four years, 70% of businesses enrolled in Blue Edge Business have received an average refund of $1,365 per employee — each year.

When is a group entitled to a refund?

There are two situations that could result in a refund to a group:

- If the group’s actual claims are less than projected, Blue Cross VT and the group share the savings equally.

- If the claims over stop loss for all of the groups in Blue Edge Business are less than projected, groups may receive a disbursement from the favorable performance. Blue Cross VT obtains approval of a distribution from the Department of Financial Regulation. Distributions have been made every year, but are not guaranteed.

How and when are refunds issued?

Refunds are calculated 8 ½ months after the end of the plan year and distributed via ACH in the fall of the following year.

2025 Blue Edge Business Health Plans

Blue Edge Business: Copay 1

| Benefit | Cost-share |

| Deductible (stacked) | $850 / $1,700 |

| Coinsurance | 30% after deductible |

| Out-of-pocket maximum (stacked) | $4,500 medical / $1,650 prescription |

| Preventive | Covered at 100% |

| Office Visits (PCP/Specialist) | $30/$50 not subject to deductible |

| Emergency Room | $500 after deductible |

| Urgent Care | $40 not subject to deductible |

| Ambulance | $50 not subject to deductible |

| Hospital Services | Subject to deductible and coinsurance |

| Prescriptions | Generic: $5 Preferred and Non-Preferred: $100 deductible the $50 preferred and 50% for non-preferred |

| New Benefit | Acupuncture will be an added benefit for 2025. |

Blue Edge Business: Copay 2

| Benefit | Cost-share |

| Deductible (stacked) | $3,000 / $6,000 |

| Coinsurance | 0% |

| Out-of-pocket maximum (stacked) | $9,200/$18,400 (includes Rx OOP of $1,650/$3,300) |

| Preventive | Covered at 100% |

| Office Visits (PCP/Specialist) | $30/$50 not subject to deductible |

| Emergency Room | $500 after deductible |

| Urgent Care | $50 not subject to deductible |

| Ambulance | $500 after deductible |

| Hospital Services | Outpatient: Deductible then $2,000 Inpatient: Deductible then $500/day |

| Prescriptions | Generic: $10 Preferred: $50 Non-Preferred: $75 |

| New Benefit | Acupuncture will be an added benefit for 2025. |

Blue Edge Business: CDHP 1

| Benefit | Cost-share |

| Deductible (aggregate) | $3,000 / $6,000 |

| Coinsurance | 0% |

| Out-of-pocket maximum (aggregate) | $3,000/$6,000 (includes Rx OOP of $1,650/$3,300) |

| Preventive | Covered at 100% |

| Office Visits (PCP/Specialist) | Subject to deductible |

| Emergency Room | Subject to deductible |

| Urgent Care | Subject to deductible |

| Ambulance | Subject to deductible |

| Hospital Services | Subject to deductible |

| Prescriptions | Subject to deductible then*: Generic: $5 | Preferred: 40% Non-preferred: 60% *wellness drugs are not subject to the deductible first, will process as $5/40%/60% |

| New Benefit | Acupuncture will be an added benefit for 2025. |

Blue Edge Business: CDHP 2

| Benefit | Cost-share |

| Deductible (aggregate) | $6,550 / $13,100 |

| Coinsurance | 0% |

| Out-of-pocket maximum (aggregate) | $6,550/$13,100 ($9,200 individual OOP max, includes Rx OOP of $1,650/$3,300) |

| Preventive | Covered at 100% |

| Office Visits (PCP/Specialist) | Subject to deductible |

| Emergency Room | Subject to deductible |

| Urgent Care | Subject to deductible |

| Ambulance | Subject to deductible |

| Hospital Services | Subject to deductible |

| Prescriptions | Subject to deductible then*: Covered at 100% *wellness drugs are not subject to the deductible first, will process as $12/40%/60% |

| New Benefit | Acupuncture will be an added benefit for 2025. |

![]()

“Blue Edge Business provides a significant advantage for us. In the last three years, we’ve received almost $40,000 in premium refunds, which we’ve been able to reinvest in our team.”

– Evan Langfeldt, CEO O’Brien Brothers

Blue Edge Business Forms & Resources

Plan Outlines & Description

- Blue Edge Business Brochure

- BEB Placemat

- CDHP 1 - One page overview

- CDHP 2 - One page overview

- Copay 1 - One page overview

- Copay 2 - One page overview

- BEB CDHP 1: SBC

- BEB CDHP 2: SBC

- BEB Copay 1: SBC

- BEB Copay 2: SBC

- BEB Summary Plan Description